income tax calculator australia

Australia Income Tax rates and thresholds for 2022 with 2022 Salary Calculator produce income tax calculations using the tax tables for 2022. This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France.

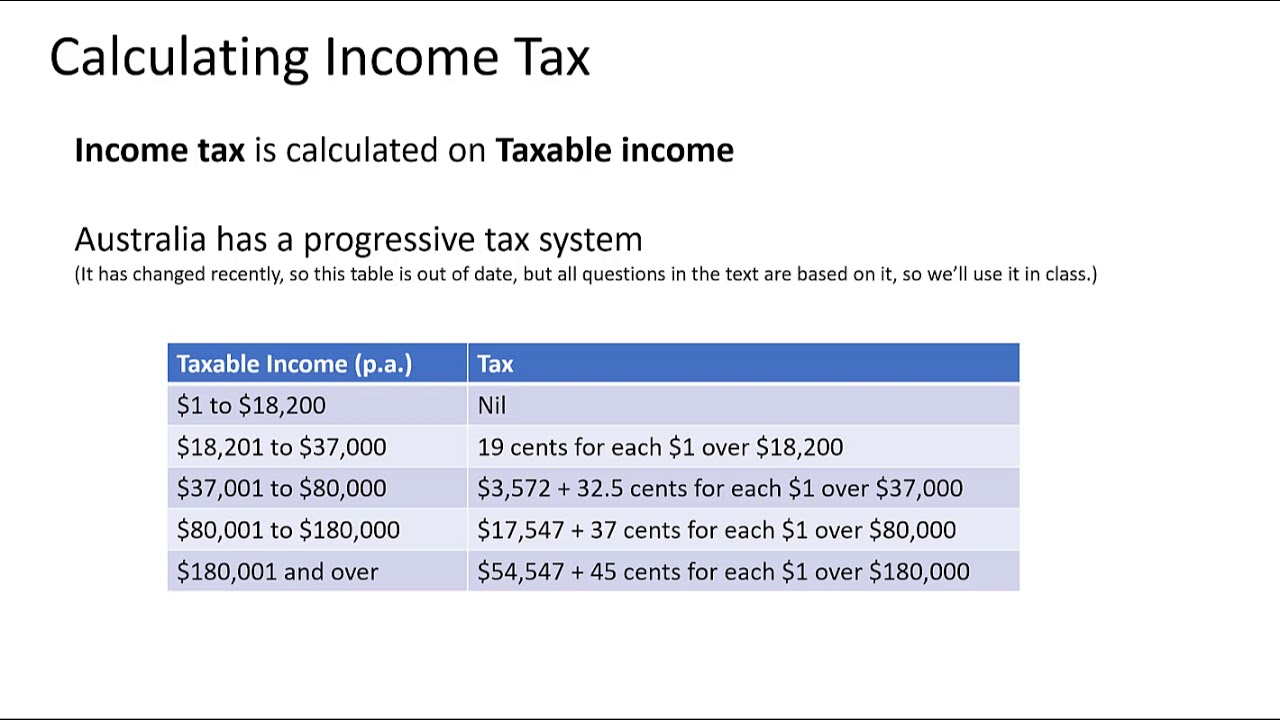

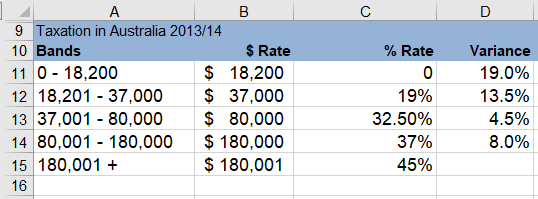

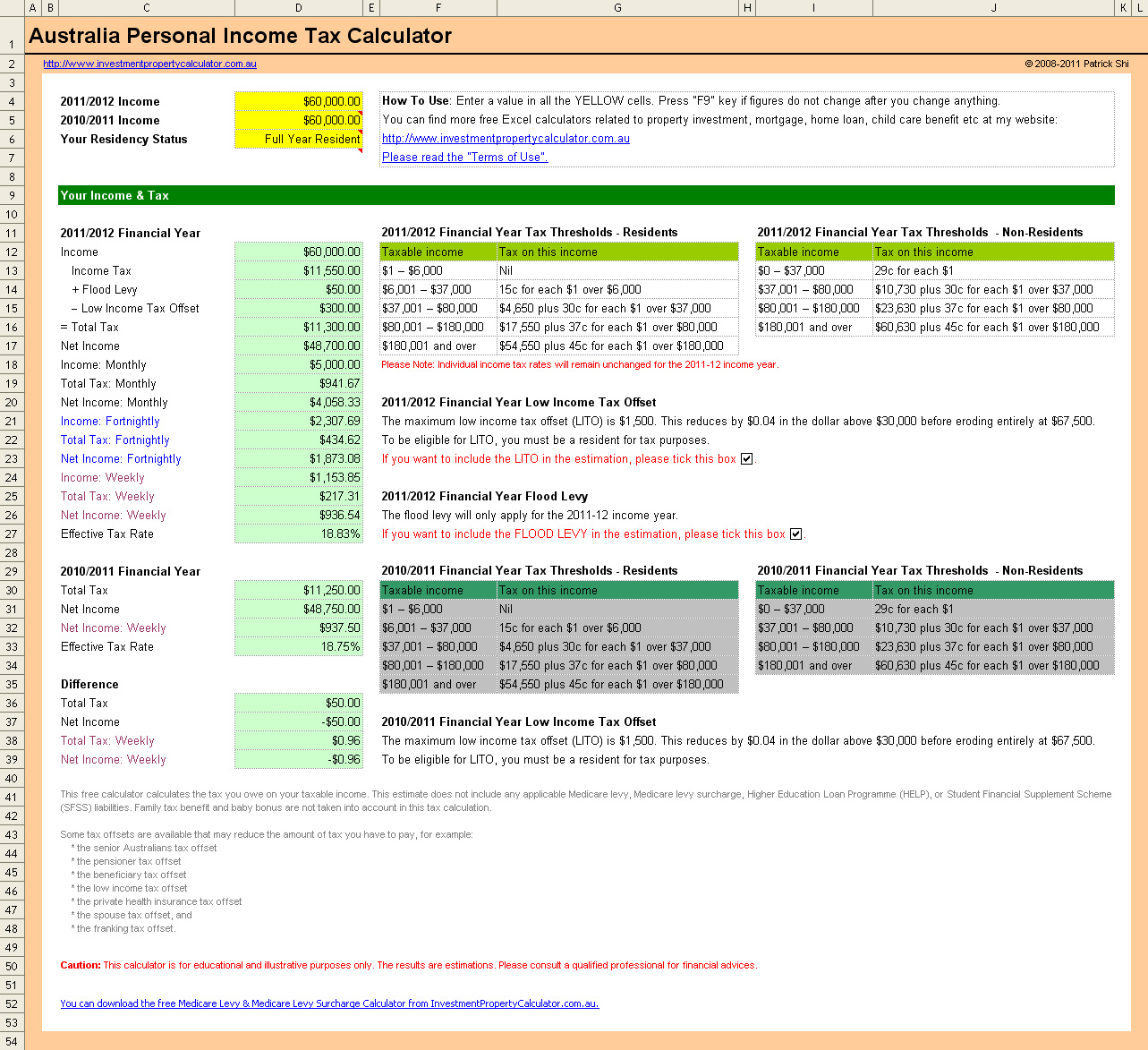

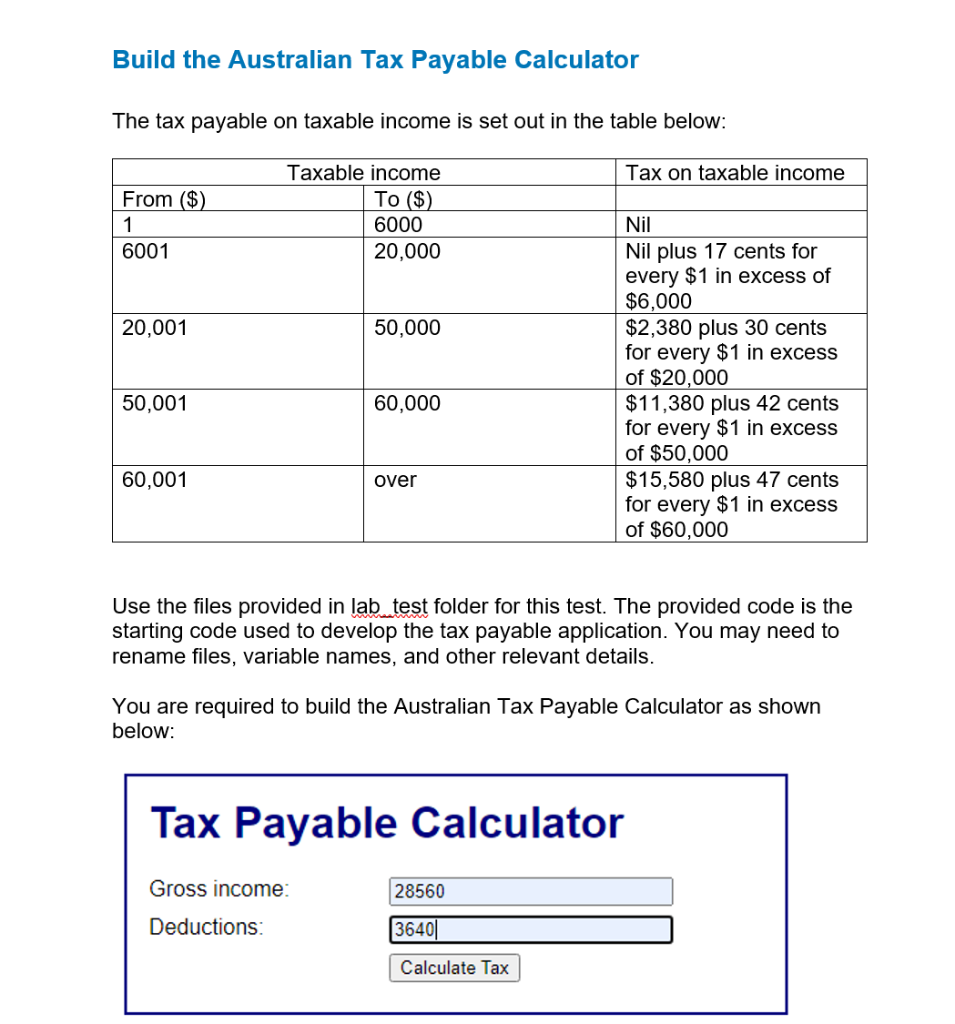

How To Calculate Income Tax In Excel

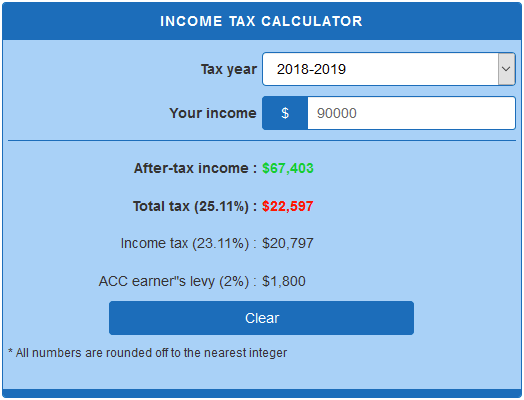

This income tax calculator computes estimated tax for Australian residents for tax purposes.

. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Goods and services Tax 2019. The personal income tax rate in New Zealand is progressive and ranges from 105 to 39 depending on your income.

RRSP annuities and insurance. Goods and services Tax 2020. Capital losses may also impact the net capital gains you need to report.

This calculator reflects the Metro Supportive Housing Services SHS Personal Income Tax for all OR county residents on taxable income of more than 125000 for single filers and 200000 for head of householdmarried filing jointly filers. Advisory Blog Market Monitor. We will send you a personalised list of tax deductions to help maximise your refund.

Janes capital gain is 10000. This marginal tax rate means that your immediate additional income will be taxed at this rate. Singapores Personal Income Tax adopts a progressive model where higher-income earning residents are required to pay a proportionately higher tax rate.

How many income tax brackets are there in Hong Kong. Goods and services Tax 2020. Income tax in Australia is imposed by the federal government on the taxable income of individuals and corporations.

Singapore Personal Income Tax. ICalculators Australian Tax Calculator includes the following tax tables expenses and allowances you can check each year if you wish to query a specific allowance or threshold used if you would like us to add additional historical years please get in touch. Income tax calculator Québec 20132014.

Australia Residents Income Tax Tables in australia-income-tax-system. Goods and services Tax. You can now use Sprintax for your US tax return.

By using Sprintax you will also get the maximum US tax refund. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. The taxation in Ireland is usually done at the source through a pay-as-you-earn PAYE system.

The Australian Salary Calculator includes income tax deductions Medicare Deductions HEPS HELP calculations and age related tax allowances. We regularly update the calculator with current tax scales to make sure that the tax payable is correct for differing income brackets. Income tax calculator Québec 20122013.

This income tax calculator can help estimate your average income tax rate and your take home pay. State governments have not imposed income taxes since World War IIOn individuals income tax is levied at progressive rates and at one of two rates for corporationsThe income of partnerships and trusts is not taxed directly but is taxed on its. CPP canada pension plan calculator 2020.

This calculator works out the amount you need to enter at Net small business income on your tax return. Capital gains are added to your assessable income to become part of your income tax. Goods and services Tax.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. The period of reference or the tax year used in this tool is from january 1st 2022 to december 31 2022. This income tax calculator can help estimate your average income tax rate and your take home pay.

Review your income tax liabilities. What is the income tax rate in Malaysia. The calculator include the net tax income after tax tax return and the percentage of tax.

Goods and services Tax. Local income tax rates that do not apply to investment income or gains are not included. By doing so you may receive a refund for some or all of the non-resident tax withheld.

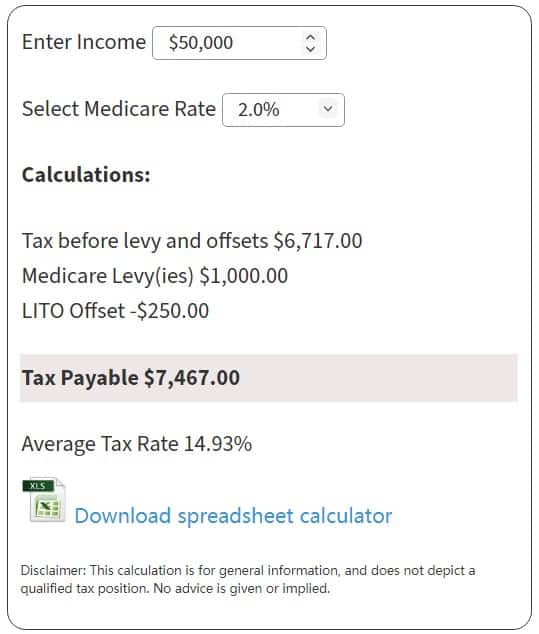

Our Tax Calculator uses exact ATO formulas when calculating your salary after income tax. In addition to income tax there are additional levies such as Medicare. How is income tax calculated in Singapore for residents.

Australia Income Tax rates and thresholds for 2023 with 2023 Salary Calculator produce income tax calculations using the tax tables for 2023. Use our tax refund calculator to get an estimate on your tax refund based on your income. For every 2 you earn over 100000 your tax-free personal allowance decreases by 1.

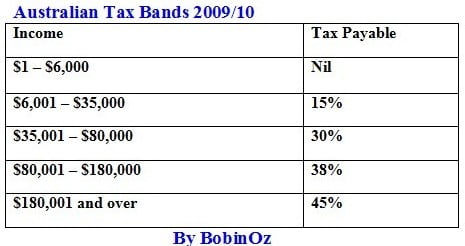

Individuals on incomes below 18200 are also entitled to the Low and Middle Income Tax Offset LMITO. Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000. Australia Tax Tables available in this calculator.

This income tax calculator can help estimate your average income tax rate and your take home pay. Your average tax rate is 154 and your marginal tax rate is 345. Goods and services Tax.

How many income tax brackets are there in New Zealand. About the Australian Tax Calculator. The income tax system in New Zealand has 5 different tax brackets.

Applies resident and non-resident capital gains tax rates and allowances in 2022 to produce a capital gains tax calculation you can print or email. However we recommend that you use a calculator on the ATO website or contact your AccountantTax Agent to confirm the tax you will pay. The small business income tax offset can reduce the tax payable on your small business income by up to 1000 per year.

The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. 2024 Tax Tables 2023 Tax Tables 2022 Tax Tables 2021 Tax Tables. The Personal Income Tax rate in Singapore is capped at 22 currently.

This means that as you earn more beyond that figure more of your total income is taxed. Crypto Tax Calculator Australia. The personal salaries tax rate from normal employment in Hong Kong is progressive and ranges from 2 to 17 depending on your income.

However under sections 216 2161 217 and 2183 of the Income Tax Act you have the option of filing a Canadian tax return and paying tax on certain types of Canadian-source income using an alternative tax method. Its fully guided more cost-effective for you and will guarantee you stay fully compliant with US tax laws. That means that your net pay will be 42283 per year or 3524 per month.

The tax rates listed above apply to England Wales and Northern Ireland. The Fund may pay distributions consisting of amounts characterized for federal income tax purposes as qualified and non-qualified ordinary dividends capital gains distributions and nondividend distributions also. Australia Residents Income Tax Tables in australia-income-tax-system.

Jane buys 5000 worth of Bitcoin and 18 months later sells it for 15000. The salary calculator for income tax deductions based on the latest Australian tax rates for 20222023. Australian income is levied at progressive tax rates.

A superb online calculator for individuals and business to calculate capital gains tax in australia. If you make 50000 a year living in Australia you will be taxed 7717. Goods and services Tax 2019.

This calculator does not take tax offsets or negative gearing into. How to calculate income tax in Australia in 2022. The income tax system in Hong Kong has 5 different tax brackets.

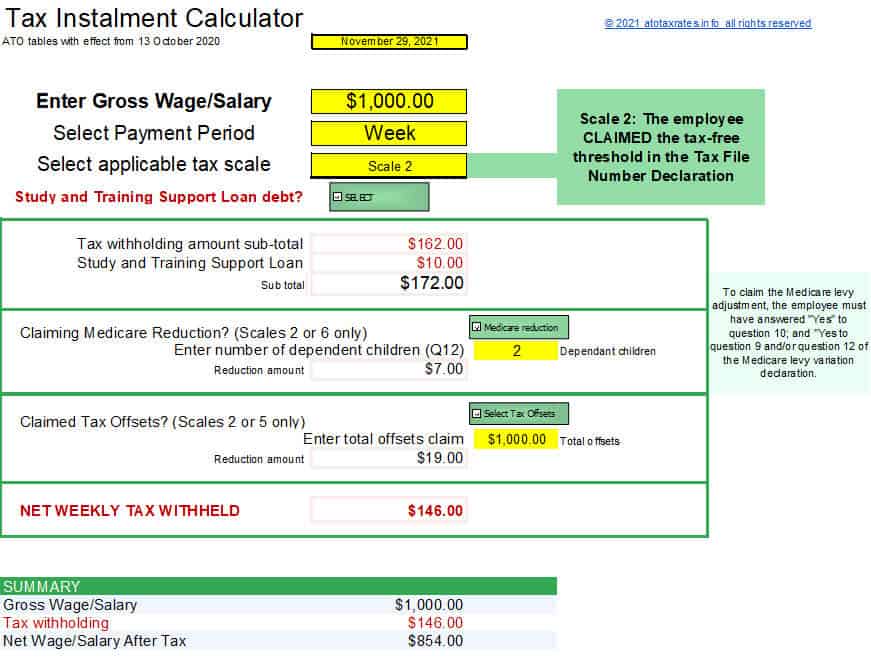

ATO tax withheld calculator or tax tables provided by the Australian Taxation Office ATO which your employer uses to calculate PAYG tax rounds your income and taxes to the nearest whole figure hence you may have some discrepancies with your actual pay on your payslip. Investment Tax Calculator.

Australian Tax Calculator Store 53 Off Www Quadrantkindercentra Nl

Australian Tax Calculator Store 53 Off Www Quadrantkindercentra Nl

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Ato Tax Calculator 2020 Online 60 Off Www Quadrantkindercentra Nl

Australian Income Tax Brackets And Rates 2021 22 And 2022 23

Ato Tax Tables 2022 Atotaxrates Info

Condition Cowboy Perth How To Set Tax In Calculator Suradam Hope Taxation

Ato Tax Calculator Clearance 58 Off Www Ipecal Edu Mx

Australian Tax Rates 2022 2023 Year Residents Atotaxrates Info

Australian Tax Calculator Store 53 Off Www Quadrantkindercentra Nl

How To Calculate The Tax In Australia Quora

Company Tax Rates 2022 Atotaxrates Info

Australian Tax Calculator Store 53 Off Www Quadrantkindercentra Nl

Tax On Wages Calculator Clearance 52 Off Www Quadrantkindercentra Nl